A business owner's policy (BOP) is an insurance product designed to support many claims. It includes several types of protections. This includes protection for your property and building. It also includes liability insurance. If a storm occurs, you may be able to file a claim with your BOP. It may help you get your business back on the ground again. Here is how to file a claim.

Storm Damage

Most BOPs pay for storm damage. This is an unavoidable and unpredictable type of loss. Storms can blow through any area in minutes. They come out of nowhere. They can damage the structure by breaking windows or tearing off the roof. As a result, this can put your equipment at risk.

Your business owner’s policy should offer enough coverage to meet any of these types of losses. However, it is important to know when it applies.

Equipment damage due to a storm is not uncommon. A lightning strike can cause an electrical surge through your business’s equipment. This can even start a fire. Other times, leaks in the roof from the storm can damage your equipment due to water. As long as the storm caused the damage, your policy should cover it. If the damage was due to normal wear and tear, or due to poor maintenance, the policy may not offer protection to you.

Getting a Claim Filed

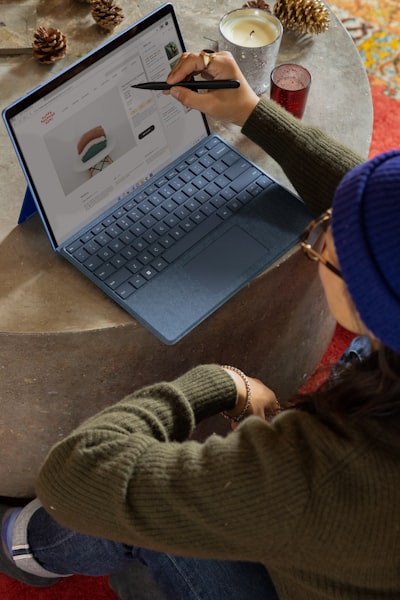

As soon as the storm hits, contact your insurance agent. Discuss what happened. Take photos of the incident, too. These can serve as your own proof of the damage. Avoid cleaning it up just yet. Your agent may need to visit the location to see what happened. In some cases, a third-party inspector or insurance adjuster may also need to visit the property. This gives them the ability to determine the cause. They can verify it was storm-related.

From here, an estimate of the damage repair is necessary. Does the equipment need repair? Is it unrepairable? Replacement may be necessary. The amount you receive from the insurer depends on the type of policy coverage you have. There is a maximum payout for most policies. However, your BOP should outline what that is at the time of selecting your policy.

Business owner’s policies provide for most types of storm-related damage coverage. However, limitations apply. Be sure your policy always represents the value of your assets, including your equipment. It can make a big difference in the long term when it comes to protecting your business operations.